Trust Foundations: Trustworthy Solutions for Your Building and construction

Wiki Article

Strengthen Your Tradition With Specialist Trust Foundation Solutions

Expert count on foundation solutions offer a durable framework that can guard your assets and ensure your dreams are lugged out exactly as meant. As we delve right into the subtleties of trust fund structure options, we discover the essential elements that can strengthen your tradition and offer a long lasting impact for generations to come.Benefits of Trust Fund Foundation Solutions

Count on structure options provide a durable structure for protecting assets and ensuring lasting financial security for people and organizations alike. Among the primary advantages of depend on foundation remedies is possession defense. By developing a trust, people can shield their properties from potential dangers such as claims, creditors, or unanticipated financial obligations. This defense makes certain that the possessions held within the trust stay secure and can be handed down to future generations according to the person's desires.Through counts on, individuals can describe how their assets ought to be managed and distributed upon their passing. Trusts also offer privacy advantages, as properties held within a trust fund are not subject to probate, which is a public and usually extensive lawful process.

Kinds Of Counts On for Legacy Planning

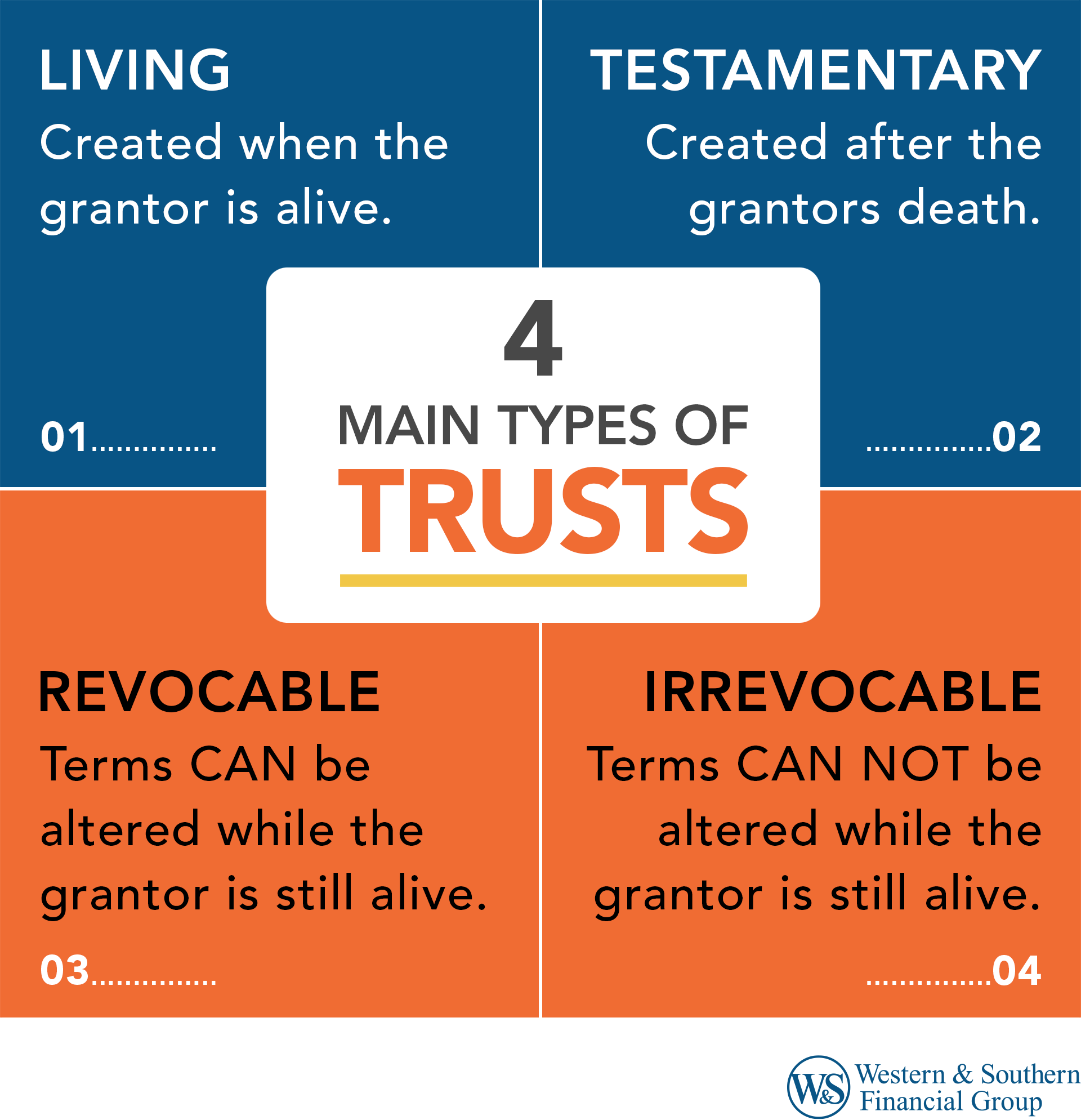

When considering heritage preparation, a vital element includes exploring various kinds of lawful instruments designed to maintain and disperse possessions effectively. One usual kind of depend on utilized in legacy planning is a revocable living count on. This trust fund permits individuals to keep control over their properties during their lifetime while ensuring a smooth change of these possessions to recipients upon their death, avoiding the probate procedure and offering personal privacy to the household.Another kind is an irreversible trust, which can not be modified or revoked as soon as established. This trust fund provides prospective tax obligation advantages and shields properties from lenders. Charitable trust funds are likewise preferred for individuals aiming to support a reason while maintaining a stream of revenue for themselves or their recipients. Special demands counts on are essential for individuals with disabilities to ensure they obtain necessary treatment and support without endangering federal government benefits.

Understanding the different sorts of depends on available for tradition preparation is critical in developing an extensive method that straightens with specific objectives and top priorities.

Choosing the Right Trustee

In the realm of tradition preparation, an essential aspect that requires mindful factor to consider is the selection of an appropriate individual to meet the essential function of trustee. Selecting the ideal trustee is a choice that can substantially influence the effective implementation of a trust fund and the satisfaction of the grantor's desires. When choosing a trustee, it is vital to prioritize high qualities such as credibility, financial acumen, integrity, and a dedication to acting in the very best rate of interests of the beneficiaries.Preferably, the chosen trustee should have a solid understanding of financial issues, be capable of making audio investment choices, and have the capacity to navigate complex lawful and tax needs. Efficient communication abilities, attention to information, and a desire to act impartially are also crucial features for link a trustee to possess. It is suggested to select someone who is reputable, accountable, and qualified of satisfying the responsibilities and commitments linked with the function of trustee. By carefully thinking about these factors and choosing a trustee that aligns with the values and purposes of the trust, you can assist ensure the lasting success and conservation of your heritage.

Tax Obligation Implications and Benefits

Thinking about the monetary landscape bordering count on structures and estate planning, it is vital to look into the detailed world of tax obligation implications and benefits - trust foundations. When establishing a count on, comprehending the tax ramifications is important for enhancing the benefits and lessening prospective find out obligations. Counts on use different tax obligation advantages depending upon their structure and purpose, such as reducing estate taxes, revenue tax obligations, and present taxes

One considerable benefit of certain trust frameworks is the capacity to move assets to beneficiaries with reduced tax obligation repercussions. For instance, irreversible counts on can remove properties from the grantor's estate, possibly reducing Extra resources estate tax responsibility. Furthermore, some counts on allow for income to be distributed to recipients, that may remain in lower tax obligation brackets, resulting in general tax financial savings for the family.

However, it is essential to keep in mind that tax legislations are intricate and subject to alter, emphasizing the requirement of talking to tax specialists and estate preparation experts to make sure conformity and make best use of the tax advantages of trust foundations. Effectively navigating the tax obligation implications of trust funds can result in substantial savings and a much more reliable transfer of riches to future generations.

Actions to Establishing a Depend On

To establish a trust fund efficiently, careful interest to detail and adherence to legal methods are crucial. The initial step in establishing a trust fund is to clearly define the function of the trust fund and the assets that will be consisted of. This entails identifying the beneficiaries who will take advantage of the trust fund and appointing a credible trustee to handle the properties. Next off, it is crucial to pick the kind of count on that finest lines up with your objectives, whether it be a revocable trust fund, irrevocable trust, or living count on.

Conclusion

To conclude, developing a depend on foundation can provide countless advantages for heritage planning, consisting of possession protection, control over circulation, and tax advantages. By picking the proper type of trust fund and trustee, people can safeguard their properties and guarantee their wishes are lugged out according to their wishes. Understanding the tax obligation ramifications and taking the necessary actions to establish a trust fund can assist strengthen your heritage for future generations.Report this wiki page